Software Never Needed to Eat the World

— How a Democratic Economy might dislodge society from the belly of the beast

I cannot continue silently playing along with my role in perpetuating the tireless march of capitalism as it devours the world and everyone in it. We never needed apps for everything. We never needed every device to become "smarter", certainly not salt dispensers. We certainly don't need every application, device, service, product, and operating system to cram "AI" down our throats.

When I was young, technology mostly improved things. Now, it mostly makes things worse. As a software engineer, former technology startup founder, and someone who has accidentally made a billionaire or two, this has chewed at me for a while. I needed to know why every product seems to be getting... shitter. Why society seems to be fracturing, quality of life trending backwards, and environmental problems accelerating when I thought we would have turned them around by now. The answer is, I think, astoundingly simple, and not at all an original idea by me, but a culmination of many insights from smarter people, each working on their piece of the puzzle.

To truly understand the answer and what we can do about it, we need to cover a key idea: "Success to the Successful". This is a pattern from systems thinking stating that inside systems which reward those who succeed with additional resources, early winners inevitably gain an insurmountable advantage.

We see this in the economy, with the consolidation of companies into a small number of large corporations. This is an example of a positive feedback loop in systems thinking, where the outputs of a process create more of its inputs, leading it to grow larger and larger until the system collapses.

Most of the organising functions in the world that have created the political, economic, and cultural systems that we live in have arisen because of systems and feedback loops of various kinds guiding humanity as a whole towards particular outcomes on the basis of probability. I don't believe in conspiracies, nor explaining the woeful state of the world through malice, ill intent, or grand schemes. With few exceptions, (psychopaths & sociopaths), people generally believe they are the hero of their story, with trauma and fear explaining a lot of the negative behaviour in societies.

With that in mind, we need to understand a few myths that have developed, quite naturally, and become prevalent in society at the expense of society.

Economic Mythology

The Myth of the Visionary Leader

Also known as the great man myth, historical events are often told through the lens of some central figure, who is then credited with almost all of the accomplishments. The most contemporary example of course being Elongated Muskrat, who did not single-handedly create Tesla, he purchased it. He did not single-handedly create SpaceX, he hired people who did. He did not single-handedly create PayPal, he founded X, a fledgling online payment company purchased by PayPal to reduce competition. Then he was fired for adamantly trying to rebrand PayPal as X and being probably the only "technologist" in history to ever demand a software business rewrite it's working software from C++ on a Nix-based OS to .Net on Windows. (Allegedly, he preferred the Windows NT UI)

The myth of the visionary leader is not benign, it comes at the expense of humility and our cooperative instincts. It lays the psychological foundation needed for profound wealth inequality to survive. It causes businesses to make poor decisions, to ignore contrary points of view and contradictory evidence.

The Myth of Independent Success

This is basically the "I pulled myself up by my bootstraps" myth. Not a single person succeeds on their own. Not one of these allegedly independently successful people somehow learned to read on their own, grew, hunted, and cooked all of their own food, mined, forged, and moulded their own metals, generated their own electricity, extracted and refined their own petroleum, manufactured their own car, laid their own roads to get to and from work, grew their own cotton or flax, harvested it, weaved it into fabric, and sewed their own clothes, and somehow found time to make a lot of money!

No, not only did these "independently successful" people benefit from a society that afforded them the opportunities that led to their success, such as education, transportation, electricity, regulations that prevented their food from poisoning them or electrical goods from burning down their house, and much more. They also benefited from people who acted as mentors, people who convinced them not to make bad decisions, people who gave them a chance, people who worked for them, people who purchased their products, people that invested in their businesses, etc.

Not getting as much help as you would have liked, or deserved, is still not succeeding independently.

Again, the negative results of this myth are quite broad. It erodes our sense of belonging, community, and the social safety net we all deserve and need at some point in our lives. Our evolutionary advantage, our great adaptation, is our ultra-social ability to cooperate beyond our direct families. We aren't just pack animals, we are super-pack animals. We aren't supposed to be independent, and no one could have built the societies we have on our own. If you were thrown in a time machine and sent back 100,000 years, you couldn't make bread on your own, let alone a toaster.

The Hustle Culture Myth

AKA the myth of the "fair go". This is the idea that everyone is afforded an equal opportunity to succeed if they just work hard enough. It plants the presupposition that the wealthy earned their wealth and power rather than extracting it from their workers, their customers, their governments, and their communities, if not simply inheriting it from forebears who had.

If an average CEO earns over 300x more than their employees, does that mean they work 300x more then their employees? They would have to work 37.5 × 300 =11,250 hours per week. Since that is more than 78x the number of hours in a week, sleep deprivation is evidently not how they are making that money.

What if the CEO left the company? Would they have to hire over 300 workers to cover the loss in productivity? Obviously not.

Never mind the fact that the people making the most money from a company isn't its CEO. It's the investors. And I don't necessarily mean the VCs running the fund, they're just the face. I mean the investors of the Venture Capital fund. So even if you went and started your own business, and somehow succeeded, chances are you'll still only make a rich person richer.

Hustle culture only motivates us to work harder making the obscenely wealthy even wealthier, and to thank them for the "opportunity".

A Society of Entrepreneurial Mythology

The proliferation of these myths insidiously and subtly replaces the idea that people's behaviour will be judged on its integrity, ethics, morals, creativity, humility, kindness, and other virtues, with the idea that people are measured by their productivity and utility. How would we know who the paragons of productivity and utility are? Why, by their wealth, of course! Never mind that wealth goes to those able to purchase wealth generating assets.

Each of these points is an entire topic unto itself, but let's get to our answer. Starting with a simple question, which of these teams would create the superior product?:

- A team trying to maximise shareholder value

- A team trying to maximise revenue

- A team trying to create something they're proud to share with their community

Maximising shareholder value incentivizes creating the worst possible product with the most superficially flattering facade. It incentivizes companies to trick us, to sell us shit we don't need, things that don't work, items that need to be replaced, and new problems disguised as solutions. The invisible hand of the market and the rational economic man are much like father Christmas and the tooth fairy— fucking make believe! People can't make perfectly rational choices, they don't have access to perfect information! The market can't correct everything, it's susceptible to psychological coercion and limited by context! Innovations that would disrupt a monopoly can be suppressed. Markets can be captured. And government influence can be bought and sold, much like chainsaws and scalpels.

The Viral Cure for the Systemic Malady

We don't need to abolish capitalism in one foul swoop, we can re-imagine it and supplant it piece by piece. Fundamentally, the idea is quite simple: we create employee-owned, democratically run companies where the objective is not shareholder value, but the creation of something worthwhile.

We replace the entrepreneurial spirit with the spirit of innovation, purpose, and creativity. Yes, these companies still sell goods and/or services, they still fulfill a need, but never a desire for wealth or power over another.

The structure and practical operation of these democratically owned-and-operated companies is actually quite straightforward once the fundamental pieces are in place. The closest existing analog to what I'm proposing would be Workers Collectives/Cooperatives, which have existed for over a century. The largest has over 80,000 employees, and there are enough workers collectives in the world that researchers have studied how these companies fare.

Typically, these companies outperform their traditionally structured counterparts. They're far more durable, having a longer lifespan, lower failure rate, and are more likely to survive economic turmoil. Their employees are happier, despite on average taking slightly lower pay, and they tend to have better mental health outcomes. Plus, they typically achieve better environmental outcomes than their traditionally structured contemporaries in the same industry (AKA fewer negative externalities).

There is no measure by which these democratic workers collectives are less successful than their counterparts, unless you are a non-employee investor. Which reflects the fact that they achieve better outcomes for everyone, including their customers, at the expense of those that would extract wealth from companies at the expense of their customers and employees!

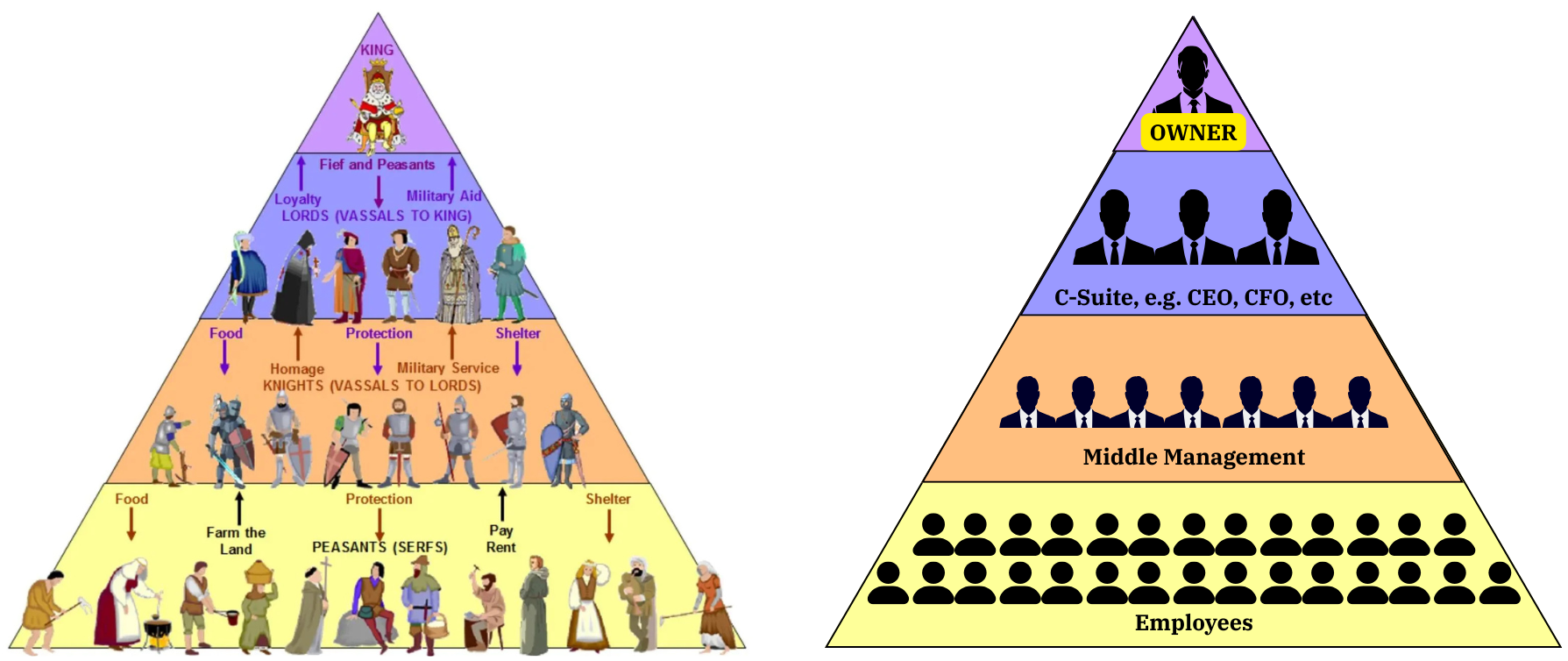

Democratic Capitalism vs Feudal Capitalism

Taking a step back to look at our history from 10,000 feet, we can draw parallels from a similar idea that developed and spread over the last few centuries: democratic government. It makes intuitive sense to us that a democratic government for the people and of the people outperforms a dictatorial regime or a feudal state. So why would we expect a feudal company to outperform a democratic company? There is no credible nor probable causal theory that could lead someone to expect a feudal company or country to outperform a democratic company or democratic nation. Unless, you have been indoctrinated into the "great man" myth.

As someone who has been in various positions throughout my career, including the head of my discipline, any greatness a person may have had before being placed in a position of authority is quickly eroded. The higher my position, the lower the scrutiny of my ideas compared to other people's, regardless of how many times I insist it's only a goofy idea. Often, my questions, genuinely borne of ignorance, are interpreted as suggestions and actioned rather than answered. Rather than my humility, which I must actively maintain, lubricating the discovery and correction of the flaws in my ideas (or questions interpreted as ideas), it seems only to help people remember the few times I was correct more easily than they remember when I was wrong.

And while my skills are eroding, so too is my willpower. Authority amplifies decision fatigue. It's like having a big red button that activates a cheat-code, letting you win any debate. Except every time that you use it, you and everyone around you suffers a debuff to their intellect (and mood), plus the button grows permanently larger, making it harder to resist next time.

A Concrete Solution, Not Abstract Philosophy

So what exactly am I proposing, in a practical sense? That we begin creating Democratic Companies, where all employees are equal owners, and the company constitution dictates that:

- All employees are issued voting shares across their first 12 months.

- All votes must use the mathematically sound quadratic voting system.

- All current employees are issued non-voting shares (profit shares) each quarter

- A departing employee's voting shares are converted to non-voting profit shares.

- Profits are shared amongst current and former employees based on total shares.

- Salaries are capped at 4x an employee's country's median wage.

- Dividend payouts are capped at an average of 1x the salary cap over 5 years.

- The company "war chest" is capped at 5x annual expenses.

- If the company's profits exceed its caps, it must take action to reduce profit.

- The company cannot sell more than 20% of its shares to raise capital.

- The company can only invest in other Democratic Companies.

- The company must not hold or use any unsanctioned financial instruments.

- Employees cannot work more then 40 hours per week.

- Only humans can be employees of the company.

What does all of that mean? Let's break it down!

Employees are issued voting shares over their first 12 months

Every quarter, employees are issued voting shares until they have accrued their full complement of voting shares. An easier way to think about this is that every employee's vote is weighted Math.min(monthsEmployed / 12, 1).

This allows their influence to ramp up as they become more familiar with the company. It prevents a cohort of new people having an outsized impact on decisions they lack context for. It also allows them to grow familiar with the voting process while the stakes are lower.

Voting must use Quadratic Voting system

Across the world, government elections use to different voting methods, but all of the methods used at scale for democratic government elections are mathematically unsound. Rather than re-explaining all of that, Veritasium made a great video about it. Instead, we will use a system called Quadratic Voting. The high level explanation is that everyone gets a fixed number of points to "spend" on their votes. "Buying" the first vote for an option costs 1 point, allocating 2 votes to 1 candidate costs 2 points, 3 votes costs 4 points, etc. So if you had 16 candidates and 16 points to spend, you could vote once for every candidate, you could place 4 votes on one candidate, etc.

What gets voted on? Anything that people have not or might not agree on! Being a software guy, I have vague designs for a system that you could think of as "Slack, for voting" — all votes would be open to everyone, but people could subscribe to topics they are interested in. Everyone would have equal capacity to make a case for their proposal. Some decisions would require a company-wide vote.

Current employees are issued non-voting shares every period

Non-voting shares, AKA profit shares are used to calculate dividend payouts. By issuing an equal number of shares to all employees every period, people are rewarded for tenure, but also all employees are trending towards an equal share. I think it accurately reflects the reality that people can help shape a company, but we're always shaping it together. If someone spends ten years at a company, yes they've had a big impact, but ten years after their departure the company will have been shaped by other people, and their share of dividends will taper off to reflect that. The more people there are in the company, the faster their contributions, and thus their payouts, taper off.

Departing employees' voting shares are converted to non-voting shares

This means that people leaving the company still receive a long-tail of decaying dividend payouts, but they don't have a say in the decisions of the company. This prevents things like an absent founder coming back and making terrible decisions because they don't have an up-to-date understanding of the company.

Profits shared amongst current & former employees based on shares

Basically, sum the voting shares and profit shares of each shareholder (current or former employee) to calculate their share of the profits. Explaining it in JavaScript again:

function calculateEmployeeDividendPayout(

/** The number of voting shares the employee holds */

votingShares,

/** The number of non-voting AKA profit shares the employee holds */

profitShares,

/** The total number of shares on issue across all current and former employees */

totalIssuedShares,

/** The total number of dollars being paid to employees from company profits */

totalPayoutDollars

) {

const employeeShares = votingShares + profitShares;

const employeeSharePercentage = employeeShares / totalIssuedShares;

return employeeSharePercentage * totalPayoutDollars;

}And that's it! Very straightforward maths, the most complicated part is understanding the variables.

Salaries are capped at 4x an employee's country's median wage

This prevents the company from inflating wages to reduce profit. I think everyone should be paid equally for their time, but there may be cases where that is plainly unfair in a way that is obvious to everyone. The cap also prevents employees from becoming excessively wealthy, because we want to be rewarded for our work rather than work for a reward. It prevents the company from becoming a vehicle to exploit its customers to enrich its shareholding-employees. I want to make sure there is never an incentive to sell a crappy product or harm people to maximise profits.

4x a country's median wage is still a bloody great salary! Here in Australia that would be a maximum base salary of $232,864 based on the $58,216 median wage. That is excluding dividend payouts, which are in addition to the base salary.

Dividend payouts capped at an average of 1x the salary cap over 5 years

This means that someone could take home, at most, 6x their salary in dividend payouts provided they have gone without a payout for 5 years. Basically, this provides a pathway-to-reward for reaching true profitability, which is generally a multi-year slog. Employees could choose to reinvest profits into growing the company for a number of years and then be compensated down the track.

However, that means the next year their dividend payout would be capped at 0.2x the salary cap, then 0.4x the following year, etc.

Of course, combining the dividend payout cap and the salary cap means total compensation is capped at 8x the median wage, which again in Australia would be $465,728 on average — enough money to live extremely comfortably without becoming a Bond villain. Or taking 5 years of payout all at once, $1,397,184.

Company "war chest" capped at 5x annual expenses

This is a limit on the cash the company can hold, preventing the company from becoming a vehicle for manipulating governments, etc. This is part of the "don't be a Bond villain" ethos, again. By basing it on expenses rather than revenue or any other metric, it gives the company room to manage its cash flow, especially in cash flow sensitive businesses that might have a high cost of goods sold and low margins.

If the company's profits exceed its caps, it must take action to reduce profit

These actions to reduce profit could be any mix of

- reducing prices, but not entirely below cost (don't price out competitors!)

- voluntarily paying more to the company's democratic vendors

- stopping production, provided doing so does not harm the company's customers

- investing in other democratic companies

This is part of being a good citizen of the community — if everyone in the company is being paid maximum salary, maximum dividends, and the war chest (savings account) is full, then the company's needs are met. There is no need to make more money, so don't! Again, don't become a Bond villain! There is such a thing as rich enough, and 8x the median wage is certainly enough. If you still don't feel rich enough, find better friends.

This way, if your business is providing a necessary good to humanity, it is forced to provide that good to people that need it at the cheapest viable price once the company's needs are met, rather than maximising returns for investors. This also gives a company plenty of flexibility to exercise strategies like selling at a higher price to a demographic that can afford it to subsidise selling below cost to a demographic that cannot.

The company cannot sell more than 20% of its shares to raise capital

At least 80% of all shares must be held by employees. The company cannot sell voting shares to investors, even if those investors are employees. Strictly no exchanges for voting shares. Why? Because investors are not good for companies, nor communities. Sometimes a company might need to raise some capital, but ultimately, yeah, these democratic companies are supposed to be good citizens, and a company that needs to raise $500,000,000 to reach profitability probably isn't providing enough value to meet the threshold of good citizenry.

Note that this does not prohibit companies raising money from their employees, only that they cannot be compensated with voting shares. This does mean an employee could invest in the company in exchange for profit shares (however, the profit cap applies).

The company must exclusively invest in other Democratic Companies adhering to The Constitution of Democratic Enterprise

Partly, this is to prevent the company's profits escaping the constitutional limits through proxies and such. The other aspect of it is again the good citizen ethos. By investing in other democratic companies, it helps propagate democratic enterprise. These companies are better for the planet, our society, and the integrity of our democratic governments.

It also creates a positive feedback loop where the success of democratic companies leads to the creation of new democratic companies. By supporting the new system over the old system, we're creating a positive feedback loop that will allow democratic companies to thrive and completely replace feudal companies.

The company must not hold or use any unsanctioned financial instruments

The company can exclusively hold cash, depreciating assets, loans of up to 25% it's revenue, and up to a 20% share in other democratic companies. It cannot purchase loans from another company — strictly no trading debt. It can take loans, preferably but not exclusively, from other democratic companies. Again, this prevents constitutional escape, but it also generally prevents financialization. Part of being a good citizen is providing concrete value, not financial instruments. With few exceptions, financial instruments only enrich the wealthy.

Note that this is a list of financial instruments the company can use, not a list of instruments it cannot use; It is an exhaustive allow-list, not a deny-list. This closes a vector of constitutional escape such as an employee of the company inventing a new financial instrument and selling it from the company to themselves to extract profits.

An employee cannot spend more then 40 hours per week working

Believe it or not, this closes yet another constitutional escape vector. An individual could not work at two democratic companies to collect double the maximum salary. They would have to divide their 40 hours between the companies that employ them and their salary & dividend payout cap at each company would be proportional to their working hour allocation.

Only humans can be employees of the company

I can't believe I had to write that, but it has to be part of the constitution! You can't create another company, trust, AI in a trench-coat, whatever, then make it an employee of the company to siphon money out of the company. Real, alive, flesh and blood, actual human f*cking people (excuse my French, I'm Australian).

Greed and Self Interest

To be clear, I am, in fact, selfish. I am proposing that democratic companies, truly owned by their employees, become the new normal for my own sake.

Based on all of the experiences I have had across my entire career, I know now that I never want to be in a position of authority ever again; I want to be part of a team. I'll want to start a company in the future, but I never again want to be a founder. I never want to be without accountability; I want to be challenged, given opportunities to grow. I never want to risk becoming someone who would be fired if I were an employee, remaining only because I was rich enough, or lucky enough, to start the company; I want to know I have earned, continuously, the privilege of working with fantastic people to build something I am truly proud of.

I never want to work for a board of investors, even indirectly, that have no knowledge or care for the company's business, customers, and employees, nor the communities and environment within which the business operates; I want to work only to delight those served by what we create. I never want to work for a company that treats people like resources; I want to work in a company that fights and makes sacrifices to protect its people when times are tough. I never want to work for a company that takes more money than it deserves, nor intentionally or knowingly harms its customers, employees, or environment; I want to work in a company that truly brings something great into the world.

I want these things, for myself, and I want everyone else to have them too! Not because I'm selfless, but because I think they will make the world I live in a better place for me and everyone I love. That is why I'm putting together systems, frameworks, and tools to create and run democratic companies — companies where all employees have voting shares, collaborate equally on the success of the company, and share the rewards of their efforts.

The Democratic Economy: Emergent Behaviour Of Democratic Companies

I know it seems unthinkable, but the more I search for signs that our current system could self-correct before catastrophe, the more evidence I find suggesting collapse is both inevitable and imminent. That the current model of capitalism is inherently self-destructive, that we are on the precipice of massive upheaval as the system collapses...

...but I also haven't been able to stop thinking about The Democratic Company. The second-order effects are really powerful, and they might just change the economic paradigm of our world.

To start, imagine a supply chain made exclusively of Democratic Companies, as defined above. For this thought experiment, let's imagine a plastic supplier called "Washminster Plastics". If Washminster Plastics becomes "financially saturated" —meaning they've reached all limits for employee salaries, dividend payouts, and holdings— their democratic constitution requires they take action to reduce profits. Often, that action will be reducing their prices. Since this democratic company sells to other businesses, reducing their prices will increase the profitability of downstream companies buying goods and services from Washminster Plastics.

It's clearly possible for one company's financial saturation to trigger a cascade of profitability and saturation throughout a democratic supply chain. It must then be that a supply chain of democratic companies —a Democratic Supply Chain, if you will— itself is financially saturated once every company within it is saturated. This financially saturated supply chain produces the lowest possible prices for consumers, yet incredibly, by the very definition of financial saturation, the wages of every worker across every company in the supply chain must have reached the compensation ceiling.

Therefore, a financially saturated supply chain of democratic companies raises real wages while lowering real prices. That's literally impossible in the current economic paradigm wherein universally increasing wages causes companies to raise prices; in other words, inflation. In a democratic economy, however, financial saturation enables real wage increases alongside deflation.

What happens to the broader economy after a supply chain reaches financial saturation? A portion of the economy's total workforce, those in the saturated supply chain, received a wage increase while also experiencing a price reduction in goods related to that supply chain. As a result, they have greater discretionary spending power — they can afford to buy more and pay more, and in turn, help democratic companies in unrelated supply chains achieve financial saturation.

So now we have a system where a single democratic company reaching financial saturation could be the first domino beginning a cascade of financial saturation. This cascade spreads, rendering an entire supply chain financially saturated, and reverberating throughout the economy — a democratic economy.

An economy of democratic companies has a different set of feedback loops; an alternative economic paradigm arising simply via the emergent behaviour of multiple democratic companies operating in aggregate. While the differences between democratic companies and feudal companies mightn't appear so drastic, the benefits to society may be gargantuan. The calculus is so alien because we aren't simply tweaking the operands of the equation, we're changing operators.

Under the current version of our society's economic operating system, the one based on feudal companies, individuals and companies can only enrich themselves to the detriment of others. Extracting value instead of providing value is the rule, rather than the exception. Yet the more a society's economy is made of democratic companies, the more commonly the success of one company enriches another. Not as the exception, but as the rule. As society, as people, a democratic economy means the wealth and success of our neighbours precipitates our own good fortune. A democratic economy is an economy devoid of zero sum games, or at least by my reckoning, far fewer.

Competition in The Democratic Economy

Let's imagine another democratic company, Athenian Figurines, a manufacturer of plastic tabletop gaming figurines. After another company, Taoiseach Games, publishes a groundbreaking video game based on an existing tabletop game, Athenian Figurines experiences a surge in orders for figurines of characters licensed from Taoiseach Games. It's great news for everyone at Athenian Figurines, but there is a problem… they're already financially saturated and have lowered their prices almost to cost. Any further price reduction would undercut other, less established, figurine manufacturers. They are faced with both an important strategic decision, and an important ethical and moral decision; their decision mustn't jeopardize the company, yet must also align with everyone's values.

So, of course, they discuss & debate before holding a company wide vote. The winning option, by a wide margin due to strong preference, is to voluntarily pay their (democratic) suppliers more. One of these suppliers happens to be Washminster Plastics, who decide to invest the extra cash into an innovative refining process proposed by one of their members (owner-employees). This is how Washminster Plastics reached financial saturation, and as I mentioned before, they wound up choosing to lower prices for their customers. It just so happens (as things tend to in the hypothetical scenarios of strange economic treatises) that one of Washminster Plastics' customers is Gladiatorial Figurines, a competitor of Athenian Figurines. Due to their reduced input costs, Gladiatorial Figurines are able to accelerate their plans to launch a new manufacturing site with state of the art equipment and processes, helping them also secure a lucrative licensing deal with Taoiseach Games.

Under our current feudal economy, the CEO of Athenian Figurines would have a fiduciary duty to shareholders to invest the "extra" cash back into the business. They may have outbid Gladiatorial Figurines on the new manufacturing site, not out of necessity but to prevent Gladiatorial Figurines from growing their business, perhaps even leaving it empty & abandoned. But that cycle is circumvented in the democratic economy, helping innovative companies continue competing against entrenched incumbents. In this example, the success of Athenian Figurines benefited at least two other companies: Washminster Plastics and Gladiatorial Figurines.

The above hypothetical demonstrates one of the feedback loops arming democratic economies with natural defences against systems traps such as Success to the Successful; That's right, this economic paradigm kills monopolies 😎 It also has goal alignment across the system: low prices aren't a defensive moat for established companies in a democratic economy, they are only a temporary maneuver. Companies are motivated to pursue quality as the most defensible differentiator and unique value proposition. This aligns the long-term goals of the company, its customers, its society, and also its employees. Given autonomy, mastery, and purpose, people are intrinsically motivated towards good work; A democratic economy is also endowed with a plethora of natural defences against enshittification.

For the planet that sustains us, a democratic economy may finally align financial incentives with environmental outcomes. Instead of endlessly ramping up production while trying to fleece vendors, employees, and customers alike, democratic businesses operate to meet their needs (achieve financial saturation) while providing value to their customers. Once those needs are met, once the company is saturated, its members may be motivated to pursue innovation out of a love for their craft or a desire to do good in the world by continuing to discover more efficient or effective solutions. Maybe some people, motivated by status or purpose, choose to continue working and innovating so they can pay more to their suppliers, invest in other democratic companies, effectively earning their status and renown through virtuous acts.

Some people, may choose to stop working until their dividend payouts dwindle. Imagine that! An economy where workers can truly earn the right to rest! If so, that's fine; The company's war chest is full, and their salaries at maximum —imagine recruiting for an open role in a saturated democratic company 🤤

A financially saturated democratic company has nothing to gain by manufacturing demand, nor manufacturing artificial scarcity. Having met the needs of their employees and their customers, a democratic company can easily do something utterly unthinkable under feudal capitalism: they could stop production.

Likewise, if a democratic company has met the needs of their employees but not their customers — meaning they achieved financial saturation before demand satiation — manufacturing artificial scarcity would only force the company to halt production prematurely. In any case, it's likely that for democratic companies, manufacturing artificial scarcity is infeasible, if not outright impossible, due to war-chest limiting rules in the constitution.

In summary, democratic companies form a democratic economy with the following properties:

- True abundance: Real wage increases coexist with, and act as leading indicators of, deflation

- Natural defenses against zero-sum games, monopolies, artificial scarcity, and manufacturing demand

- Systemic Goal Alignment: Quality of goods, innovation, and quality of life

This is because democratic companies:

- Have a predefined financial ceiling, that when reached dictates they must do one or more of:

- Lowering their prices (downstream benefits)

- Paying their vendors more (upstream benefits)

- Stopping production (environmental & social benefits, provided market demand has ceased)

- Share responsibility and decision making amongst ALL employees using Quadratic Voting

- Preference other democratic companies when choosing to lower their prices or pay vendors more

- Disallow non-employee shareholders from making up more than 20% of profit shares

- Disallow voting shares being held by non-employee shareholders

And because people will

- Prefer to work for democratic companies

- Perform better at democratic companies because of the natural alignment of incentives, the increased autonomy and responsibility, better working conditions, and the shared ownership & rewards

- Prefer to purchase from democratic companies due to their social alignment

Together, these factors create a system of feedback loops that gradually erode the advantages accrued by feudal companies via the Success to the Successful system trap, while simultaneously providing an incentive for democratic companies to be good citizens and remain democratic.

A democratic economy also forms a mutually reinforcing relationship with democratic governments. A democratic economy cures many of the ailments jeopardizing modern democracy, while a well functioning democratic government can support and enhance the smooth operation of democratic companies. This support from government for democratic companies could take many forms, such as providing independent financial auditors checking adherence to the constitution of democratic enterprise, maintaining a registry of verified compliant democratic companies, applying tax benefits and financial incentives for democratic companies, and more. Interestingly, governments will likely find financial incentives far more effective with fewer perverted outcomes in a democratic economy, since the inflationary effects of financial incentives, or stimulus programmes, would be dampened.

It's easy to forget that there was a point in human history, rather recently, when no living person had experienced a democratic government. To them, the idea of democracy must have sounded completely alien and impossible; "Good sir, surely you do not in earnest propose such preposterous idea as allowing the peasants to govern themselves?! Against the natural order determined by God?! Haha, you are ever the larrikin! Next you'll propose we allow women to partake in this so called 'democracy' too!"

Yet now we take the idea of democracy for granted to such an extent that we almost perceive it as a natural state of order arising spontaneously, but that couldn't be further from the truth. Some nations attempted to form democratic governments and failed several times before succeeding. In one instance, a nation spent 13 years trying and failing at democracy until they finally engineered a system that worked rather successfully for the next 230-ish years. I'm talking, of course, about the USA.

So while it has never been done before, we are in fact moments away from the genesis of the democratic economy. We might never have had the experience of working at a democratic company in our lives… so far, but all we need is a few of us to start companies with a democratic constitution and a handful of like-minded individuals.

Starting a democratic business is a lot more achievable than starting a democratic government. None of us can begin the democratic economy ourselves. Yet once two democratic companies do business together for the first time, we have given life to a democratic economy that might just nudge the trajectory of human history towards a brighter destination. Creating new companies is so simple, there's nothing stopping us from starting the world's first democratic economy tomorrow.

The Gift and the Ask: Beginning the Democratic Economy

I want us to create —for ourselves, our loved ones, the world, everyone— a chance to work at a democratic company and experience life in a democratic economy within our lifetimes. But to do that I need your help.

Firstly, I need people to interrogate these ideas in good faith, find the gaps in my thinking, and illuminate my blind spots. Everyone, from all walks of life, can contribute to our vision of the democratic economy.

We also need help from people with very specific skill-sets! In particular:

- We need lawyers to help us create template democratic constitutions people can use to start their democratic businesses in different regions around the world.

- We need economists to help us flesh out our demo-economic (democratonomic?) models, helping us refine the democratic constitution and supporting systems.

- We need great communicators to help us spread the ideas and benefits of the democratic economy clearly and broadly to diverse audiences across all walks of life.

- We need translators to help us share the vision and resources beyond the english speaking portion of the world.

- We need accountants and financial experts to help us create the accounting systems and financial tools democratic companies need to ensure they are following the democratic constitution.

- We need software engineers & product designers to create business software tailored to the specific needs of democratic companies.

- We need people with skills in mathematics, statistics, programming, economics, anthropology, and psychology to help us create economic simulations across multiple techniques and levels of fidelity, to help us preemptively identify unintended consequences or missed opportunities.

At the moment, I'm just one person cursed with an inescapable conviction that these ideas might just lead to something great if we give them a go. That means any and all help at this early stage is enormously helpful, meaningful, and motivating!

I'm curious what other people think, but my current feeling is that putting Democratic Economy content behind a paywall would be disingenuous and counterproductive. I'm not sure what I could offer paid subscribers, but I'm extremely open to suggestions!

But most importantly, a free subscription tells me that people care about this idea, that it's worth getting up in the morning and working on it, that I'm not alone. So if the idea of a Democratic Economy tickles your fancy, you want to be involved, or think it has even a trivial chance of success, please take a moment to signup!